What are the benefits of encouraging the use of mobile financial services among MSMEs?

This article is the first of a series of two blog posts looking at the issue of driving the uptake of mobile financial services among MSMEs. It provides an overview of the benefits from increasing adoption of mobile money among MSMEs. The next article will look at different ways regulators can encourage the adoption of mobile financial services among MSMEs.

In developing markets, formal Small and Medium Enterprises (SMEs) [1] contribute up to 45% of employment and 33% of GDP according to the Global Partnership for Financial Inclusion (GPFI). As such, the broad MSMEs segment has a significant role in overall economic growth, economic stability, employment and job creation, as well as addressing inequality and poverty reduction in the regions of the world that need sustainable inclusive development the most. In that context, increasing the adoption of mobile financial services among MSMEs could have tremendous benefits for the society as a whole.

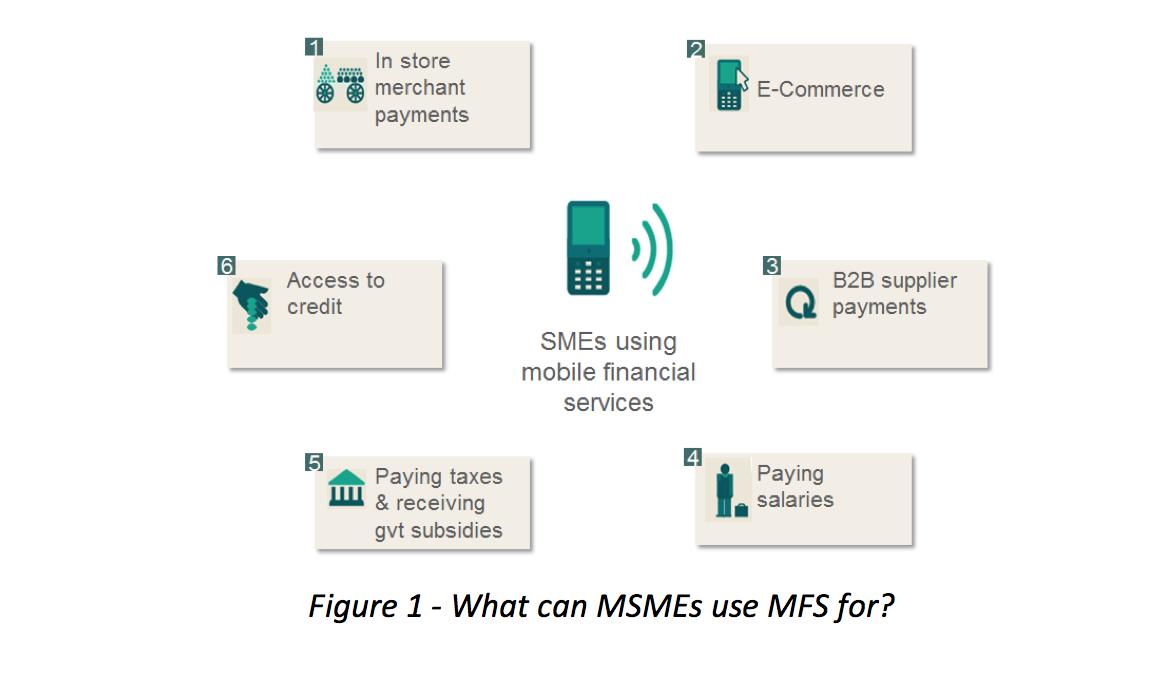

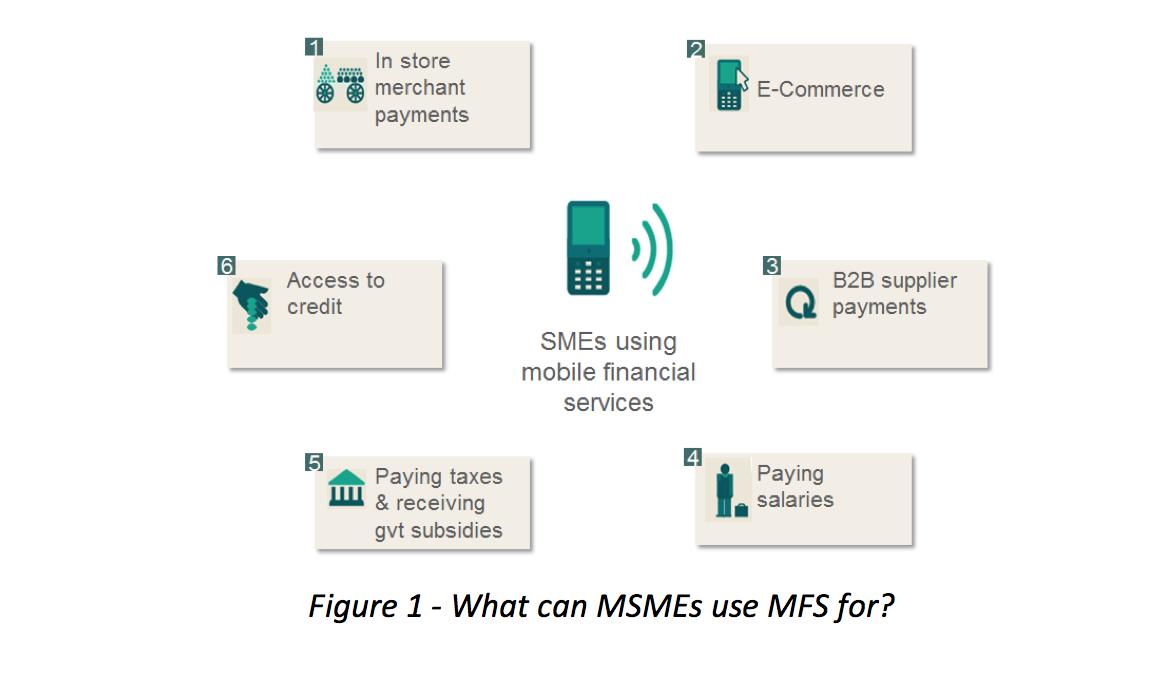

There are many ways MSMEs can use mobile financial services, as outlined in figure 1:

- to receive payments from their customers, both in-store (1) and remotely (including online) (2);

- to make payments to their suppliers (3) or employees (4);

- for government payments and for receiving government subsidies (5);

- and even to access credit (6).

All these different mobile financial services, including mobile money products can help MSMEs address a number of the financial challenges they typically face, including overall book keeping capabilities, cash flow and liquidity management and limited access to credit. However, this market remains largely untapped. For example, merchant payments only represented 1.9% of the total number of mobile money transactions in December 2015 and 4.1% of the value.

Despite this, mobile financial services can offer MSMEs several important benefits.

Benefit #1: Using mobile financial services can be a critical step for MSMEs to be financially included and join the formal economy

The vast majority of MSMEs in low-income countries are in the informal sector and are not financially included. In fact, around 90% of MSMEs in emerging markets are classified as unserved or underserved, and close to half of them have no deposit banking accounts. MSMEs are also largely owned by women and rural entrepreneurs (women entrepreneurs own more than half of African SMEs; up to 70% of rural population active in formal and informal SME sector) [2], which are segments that are still facing big challenges when it comes to become financially included.

For many MSMEs, opening a mobile money account is the first time they ever use formal financial services, and as such, it represents a key step for them to join the formal economy. An MSME that steps in the e-money ecosystem will get the opportunity to link and perform financial transactions with all other ecosystem participants which will provide such MSME with several different business possibilities and also with a very necessary presence within the economic cycle as another recognized agent driving the economy.

Macroeconomic benefits have already been reported in markets where mobile money penetration is high. In Uganda for example, the Central Bank has noted that allowing B2G as well as P2G payments through mobile money has led to an increase in the country’s overall tax collection. In Kenya, the Central Bank has recognized the impact of mobile financial services on economic growth and monetary policy, including the decrease in the amount of money that is being held outside the formal financial system which helps monetary tools to be more effective while pursuing macroeconomic stability for the country.

Benefit #2: Mobile money can help MSMEs be more productive and increase their revenues

Using mobile money is a clear opportunity for MSMEs to increase their productivity and revenues in many ways, some of those include the following:

- Mobile money can help MSMEs increase transaction speed and reduce outstanding credit times, allowing SMEs to improve their overall payment collection;

- Globally, less than 10% of SMEs accept cards and it’s less than 1% in Sub-Saharan Africa [3]. Mobile money can be a solid first step for MSMEs towards accepting digital payments in low-income markets as it doesn’t require to have a bank account nor a payment card POS which can be expensive and difficult to acquire given the nature of most unserved and underserved MSMEs worldwide.

- By allowing customers to make payments remotely via mobile money, either through mobile enabled solutions or online, MSMEs can also extend their pool of customers and sell their goods and services more widely;

- Additional benefits include increased efficiency from time saved, improved logistics and decreased administrative costs.

While little research is available to quantify the impact of the adoption of mobile money on MSMEs productivity and revenues, there is anecdotal evidence of this [4]. The Central Bank of Uganda hasnoted how mobile money has helped companies to improve their efficiency, specifically reducing their administrative costs and the time required to collect payments.

Benefit #3: Using mobile data for credit scoring can help increase access to finance for a greater number of MSMEs

In developing countries, most of MSMEs lack access to appropriate credit services. According to CGAP, the credit gap for MSMEs in emerging countries lies between USD 1.5 and 2.5 trillion. In fact, because of their high risk of default resulting from the limited collateral they can offer, and owing to the lack of information regarding their solvency, most MSMEs can rarely meet the criteria established by regulated financial institutions’ financing policies. The recent global financial crisis has further increased the financing gap in developing countries, particularly because the new regulations and policies are more stringent and conservative therefore affecting MSMEs’ chances.

This challenge is particularly strong in Sub-Saharan Africa, where only 22% of enterprises have a loan or a line of credit at a formal financial institution, compared to 43% on average in other developing economies according to data from the World Bank Enterprise Surveys. In Sub-Saharan Africa, 45% of firms also cite access to finance as a major constraint to growth. In addition, when finance for SMEs is available, it is often expensive and short term: research conducted by the African Development Bank shows that SMEs in Africa are charged interest rates in excess of 20% and often pay a premium compared to prime customers.

In that context, mobile financial services can play a critical role in boosting access to credit services in developing countries. In the Kopo Kopo Grow model in Kenya, any business accepting Lipa na M-PESA or credit card payments is eligible to apply for an unsecured cash advance. Also in Kenya, research[5] shows that 14% of M-Shwari users said they borrowed money to make business-related investments as the second most popular reason after the need to manage short-term ups and downs in cash flow. This clearly indicates that this mass-market product has been effectively serving the needs of micro and small business owners. In that context, the Central Bank of Kenya has already publicly recognized the importance of such mobile financial services to expand access to credit and their impact on the country’s economic growth.

As a growing number of regulators and MFS providers are starting to look at MSMEs, the GSMA will continue to gather insights on this topic. Please share your experience as a comment below or directly at mobilemoney@gsma.com.

The Alliance for Financial Inclusion addresses topics related to Digital Financial Services and SME Finance within their several initiatives and particularly in the DFS Working Group and the SME Finance Working Group. Comments and inputs are welcome directly at dfswg@afi-global.org and smef@afi-global.org.

Notes

[1] The definition of MSMEs is usually based on variables that intend to measure the size of their operations, such as sales turnover, full-time employees and sometimes even the value of their assets. Some countries like Malaysia have even established different thresholds for different sectors of the economy, i.e. manufacturing and services. Other factors can also be taken into account, such as the size of the country’s population, the business culture, and the level of international activities, just to mention a few.

According to the IFC, SMEs are those companies that qualify under two of the following three indicators:

- MICRO ENTERPRISE: Number of Employees less than 10, Total Assets less than US$100,000 and Total Annual Sales less than US$100,000.

- SMALL ENTERPRISE: Number of Employees between 10 and 50, Total Assets between US$100,000 and US$3.0 million, Total Annual Sales between US$100,000 and US$3.0 million.

- MEDIUM ENTERPRISE: Number of Employees between 50 and 300, Total Assets between US$3.0 million and US$15.0 million, Total Annual Sales between US$3.0 million and US$15.0 million.

[2] Policy note by Development Bank of Southern Africa and MasterCard research.

[3] MasterCard research.

[4] A 2013 study from BCG demonstrates that SMEs doing business relying on the web saw bigger growth rates than those not using internet, e.g.: their revenue growth is 7 percentage points higher than average.

[5] Value-added Financial Services in Kenya: M-Shwari Findings from the Nationally Representative FII Tracker Survey in Kenya (Wave 1) and a Follow-up Telephone Survey with M-Shwari Users, January 2015, InterMedia.

ABOUT THE AUTHORS

Ricardo Estrada is the Digital Financial Services Policy Manager at the Alliance for Financial Inclusion. Claire Scharwatt is the Senior Market Engagement Manager, MENA & West Africa, for the Mobile Money Programme at GSMA.

About

About

Online

Online

Data

Data