Digital financial services (DFS) comprises a broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances and insurance. It also includes mobile financial services.

AFI’s Digital Financial Services Working Group (DFSWG)

A platform for policymakers to discuss regulatory issues relating to digital financial services, including mobile financial services, branchless banking, electronic money and digital payment solutions.

DFSWG aims to promote digital financial services as a major driver of greater financial inclusion in emerging and developing countries.

It encourages policymakers to exchange experiences to develop a shared understanding of the risks in emerging digital financial services business models.

At the same time, it works with global standard-setting bodies in order to represent the voice of developing and emerging countries.

DFSWG aims to promote digital financial services as a major driver of greater financial inclusion in emerging and developing countries.

It encourages policymakers to exchange experiences to develop a shared understanding of the risks in emerging digital financial services business models.

At the same time, it works with global standard-setting bodies in order to represent the voice of developing and emerging countries.

Why You Should Join AFI’s Digital Financial Services Working Group (DFSWG)

The Digital Financial Services Working Group (DFSWG) is one of AFI’s most dynamic and impactful technical working groups, offering a global platform for financial regulators and policymakers to co-create inclusive policies, shape innovative regulatory frameworks, and champion financial technologies and digital transformation that foster inclusive finance.

For AFI member institutions, this is more than a platform—it’s a movement: one that continues to shape the future of digital financial services (DFS) by embedding financial inclusion at the heart of innovation and regulation.

The Digital Financial Services Working Group (DFSWG) is one of AFI’s most dynamic and impactful technical working groups, offering a global platform for financial regulators and policymakers to co-create inclusive policies, shape innovative regulatory frameworks, and champion financial technologies and digital transformation that foster inclusive finance.

For AFI member institutions, this is more than a platform—it’s a movement: one that continues to shape the future of digital financial services (DFS) by embedding financial inclusion at the heart of innovation and regulation.

What the DFSWG Offers:

1. In-Person Global Convenings & Meetings

Come together. Learn together. Lead together.

DFSWG members convene twice annually for in-depth, multi-day meetings. These sessions are designed to stimulate cross-border collaboration, peer learning, and policy innovation. Delegates explore real-world solutions to DFS challenges, grounded in practical experience and shared ambition to make financial systems more inclusive.

2. Technical Peer Reviews

Quality through collaboration.

Members gain the opportunity to review and refine draft policy documents through a structured and constructive peer review process. By drawing on collective expertise from across the network, this process elevates policy outcomes, fosters regional harmonization, and promotes fit-for-purpose regulation tailored to real-world complexities.

3. Peer Learning Exchanges & Exclusive Access to Insights

Learn from the frontlines of innovation.

From peer exchange programs to exclusive data access, DFSWG members benefit from insightful case studies, market trends, and evidence-based regulatory experiences that accelerate effective policy development. Learn how fellow regulators are navigating DFS evolution, de-risking, and financial integrity while advancing inclusion.

4. Access to Technical Discussions, Webinars, and Capacity Building

Build the knowledge to lead.

AFI facilitates technical deep-dives, hands-on workshops, and high-level webinars that equip DFSWG members with the latest tools, skills, and insights. These capacity-building engagements are aligned with emerging DFS priorities and global developments, helping members remain at the forefront of digital regulation.

5. Knowledge Products & Policy Guidance

Turn insights into action.

The DFSWG works as a collaborative body to co-develop practical, evidence-based knowledge products, including policy toolkits, guideline notes, case studies, and special reports. These resources amplify your institution’s visibility, provide tested policy roadmaps, and support measurable impact in advancing inclusive DFS ecosystems.

6. A Platform to Showcase Your Success Stories

Your voice. Your impact. Your leadership.

DFSWG offers members the chance to showcase national DFS strategies, policy breakthroughs, and financial inclusion interventions on a global stage. Share your journey and inspire others—because when one institution leads, the whole network learns.

7. A Global Network of Peers & Partners

Contribute to—and benefit from—the collective.

By joining DFSWG, you become part of a globally recognized policy leadership alliance of central banks, regulators, and financial authorities. This network is driven by a shared vision: to leverage digital innovation for inclusive, resilient, and sustainable financial systems. Whether you’re contributing expertise or drawing from others’ success, your participation strengthens the global policy ecosystem.

1. In-Person Global Convenings & Meetings

Come together. Learn together. Lead together.

DFSWG members convene twice annually for in-depth, multi-day meetings. These sessions are designed to stimulate cross-border collaboration, peer learning, and policy innovation. Delegates explore real-world solutions to DFS challenges, grounded in practical experience and shared ambition to make financial systems more inclusive.

2. Technical Peer Reviews

Quality through collaboration.

Members gain the opportunity to review and refine draft policy documents through a structured and constructive peer review process. By drawing on collective expertise from across the network, this process elevates policy outcomes, fosters regional harmonization, and promotes fit-for-purpose regulation tailored to real-world complexities.

3. Peer Learning Exchanges & Exclusive Access to Insights

Learn from the frontlines of innovation.

From peer exchange programs to exclusive data access, DFSWG members benefit from insightful case studies, market trends, and evidence-based regulatory experiences that accelerate effective policy development. Learn how fellow regulators are navigating DFS evolution, de-risking, and financial integrity while advancing inclusion.

4. Access to Technical Discussions, Webinars, and Capacity Building

Build the knowledge to lead.

AFI facilitates technical deep-dives, hands-on workshops, and high-level webinars that equip DFSWG members with the latest tools, skills, and insights. These capacity-building engagements are aligned with emerging DFS priorities and global developments, helping members remain at the forefront of digital regulation.

5. Knowledge Products & Policy Guidance

Turn insights into action.

The DFSWG works as a collaborative body to co-develop practical, evidence-based knowledge products, including policy toolkits, guideline notes, case studies, and special reports. These resources amplify your institution’s visibility, provide tested policy roadmaps, and support measurable impact in advancing inclusive DFS ecosystems.

6. A Platform to Showcase Your Success Stories

Your voice. Your impact. Your leadership.

DFSWG offers members the chance to showcase national DFS strategies, policy breakthroughs, and financial inclusion interventions on a global stage. Share your journey and inspire others—because when one institution leads, the whole network learns.

7. A Global Network of Peers & Partners

Contribute to—and benefit from—the collective.

By joining DFSWG, you become part of a globally recognized policy leadership alliance of central banks, regulators, and financial authorities. This network is driven by a shared vision: to leverage digital innovation for inclusive, resilient, and sustainable financial systems. Whether you’re contributing expertise or drawing from others’ success, your participation strengthens the global policy ecosystem.

0

Member

Institutions

Institutions

0

Countries

0

Policy changes

0

Knowledge products

Chairs & Focal Points

Chair

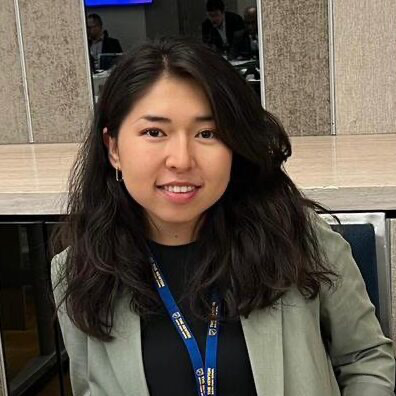

Tsolmontuya Bold, Financial Regulatory Commission of Mongolia

Co-Chair I

Abdulrahman Ababneh, Central Bank of Jordan

Co-Chair II

Eserani Munivai, Reserve Bank of Fiji

Gender Focal Point Lead

Linda Dlamini, Central Bank of Eswatini

Gender Focal Point Co-Lead

Lim Sheng Ling, Bank Negara Malaysia

Objectives

Member Institutions

Subgroups & Planned Activities

Maya Declarations

DFSWG & Gender

DFSWG & Regional Initiatives

Latest Publications

DFSWG News & Blogs