AfPI is the primary platform for AFI’s African members to support and develop financial inclusion policies, regulatory frameworks and other knowledge products in Africa, and to coordinate regional capacity building and peer learning efforts. Unveiled in May 2017, in Maputo, Mozambique, AfPI succeeds the African Mobile Phone Financial Services Policy Initiative (AMPI), which was launched in February 2013.

From AFI’s regional office in Abidjan, Côte d’Ivoire, AfPI brings together high-level representatives from financial policymaking and regulatory institutions in Africa. Stakeholders from private sector entities, telecommunications regulators and international development agencies also participate in and support AfPI activities. By establishing a platform for public and private engagement, AfPI aims to enhance the implementation of innovative financial inclusion policies in Africa.

Key AfPI initiatives include leaders’ roundtables, private-public dialogues, capacity building workshops, developed-developing country dialogues and experts group on financial inclusion policy meetings (EGFIP).

Plateau, Avenue Marchand Rue Lecoeur Immeuble SCIAM, 12ème étage 17 BP 412 Abidjan 17 Abidjan, Côte d'Ivoire

+225 20 22 16 10

CHAIR

Governor, Central Bank of Seychelles

CO-CHAIR

Governor, Bank of Ghana

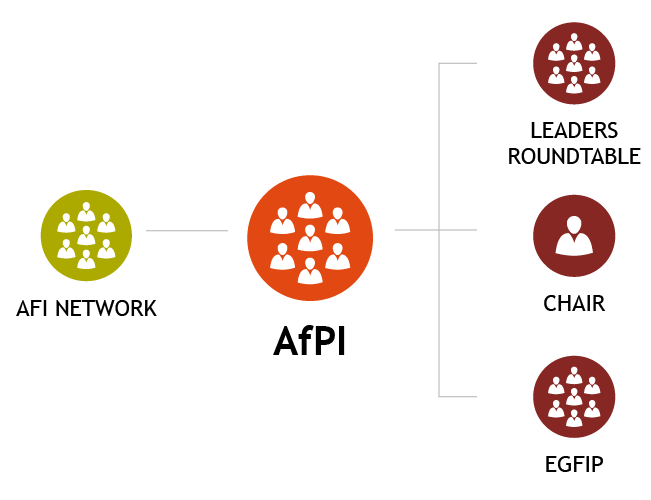

AfPI is part of the AFI network and any AFI member institution in Africa can participate in AfPI activities. AfPI operates under a governance structure consisting of the leaders’ roundtable, the chair and EGFIP. The chair serves for a two-year term and is replaced by the vice-chair at the end of the term. A new vice-chair is then elected.

AfPI activities are implemented and coordinated through the following mechanism:

© Alliance for Financial Inclusion 2009-2024