Overview

Increasing women’s financial inclusion and narrowing the gender gap through gender responsive financial policy and regulation has been at the forefront of AFI’s policy discourse since the Denarau Action Plan (DAP) was adopted in 2016 at the annual Global Policy Forum in Fiji.

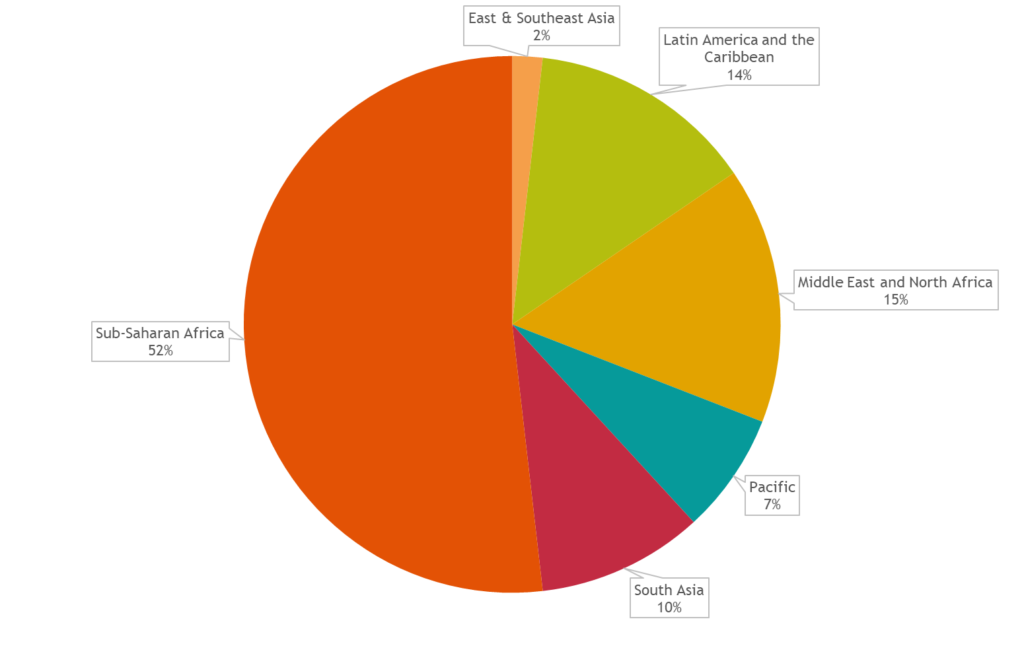

Significant gains in financial inclusion have been made in recent years. The Global Findex revealed that the gender gap in access to financial services has narrowed for the first time, from 9% in 2011 to 6% in 2021, though it remains significantly wider in parts of South Asia, the Middle East, and North Africa, as well as a few sub-Saharan African economies, leaving 745 million women financially excluded. Still, much work needs to be done to address structural inequalities that deny women economic opportunities and to ensure economic benefits are shared equally.

Greater financial inclusion of women also makes business sense with estimates suggesting that advancing women’s equality could add some USD12 trillion to global gross domestic product by 2025. Women-led small and medium enterprises (SMEs) already make significant contributions to the economies in which they operate. They account for a third of all SMEs, a segment that has long been recognized as an important engine of growth and job creation.

Alongside gender-sensitive policies, collecting and analyzing sex-disaggregated data is essential to address this gender gap as it can both inform evidence-based financial inclusion policymaking and track the effectiveness of efforts to address barriers faced by women.

The Gender Inclusive Finance workstream is partially financed by Sweden and other partners.

Denarau Action Plan (DAP)

Since the adoption of the DAP, in 2016, which was updated by members in 2022 to note the progress the network has made to date and to have and intentional focus on the sustainable usage of quality financial services by women, financial regulators and policy makers have continued to concentrate their efforts in developing and implementing policies and regulations that are gender sensitive. The goal of the original Denarau Action Plan was for AFI members to halve gender gaps in financial inclusion in their respective jurisdictions by the end of 2021, and many members have already achieved this, or have made significant reductions. It is positive to see that efforts by AFI members have contributed to the reduction in the overall global gender gap in women’s access to formal financial products and services by three percentage points, from nine percent since 2011 to six percent in 2021 across developing and emerging economies.

Strategic guidance and leadership to the AFI network in advancing and promoting gender inclusive finance are provided by the high-level AFI’s Gender Inclusive Finance Committee (GIFC), which was established at the 2017 AFI GPF in Sharm El Sheikh, Egypt. Committee members are the Bank of Ghana (Chair), Bangladesh Bank (Vice-Chair), Bank Al-Maghrib, Palestine Monetary Authority, Banco Central del Paraguay, Bank of Uganda and Reserve Bank of Zimbabwe.

Since adopting the DAP in 2016, close to 60 knowledge products were developed and published covering various thematic topics to guide policy and regulatory efforts that drive gender inclusive finance. Under the Maya Declaration, more than 45 members have committed to at least one target related to gender inclusive finance. 52 policy changes in the area of gender inclusive finance have been reported by 29 member institutions.

Leadership and Diversity Program for Regulators

As part of the program to create a pipeline for future women leaders, the bespoke LDR global capacity building program continues to be well-received and is highly successful within the AFI network., This 12-week program, delivered in collaboration with Women’s World Banking and Oxford University’s Saïd Business School, brings together senior officials from central banks and other regulatory agencies and high-potential women from their respective institutions to develop policy initiatives that help close the gender gap in financial inclusion, promote greater institutional gender diversity in regulatory institutions

Applications for the next cohort of the Leadership and Diversity Program for Regulators will open in the spring of 2024.

Learn more here.

About

About

Online

Online

Data

Data