Improving livelihoods through economic and financial inclusion is a key component of achieving protection and long-term solutions for the refugee situation. Economic inclusion contributes to the self-reliance and resilience of refugees and other forcibly displaced persons, empowering them to meet their needs in a safe, sustainable and dignified manner, avoid aid-dependency, contribute to their host economies, and prepare for their future whether they return home, integrate in their country of asylum, or resettle in a third country.

Self-reliance is often contingent to the ability of forcibly displaced to have access to financial services such as loans and credit lines, savings accounts and payment services. Most forcibly displaced, in particular refugees, are today excluded from the formal financial sector, which means they lack a safe place to save and receive money, affordable ways to make payments, and access to loans to invest in a business activity or to smooth their consumption needs.

Ongoing global processes such as the Comprehensive Refugee Response Framework (CRRF) and the focus on the humanitarian-development nexus show the need for and benefit of taking a holistic approach which requires the engagement of a broad range of stakeholders, leveraging the value-add and strategic positioning of each of them.

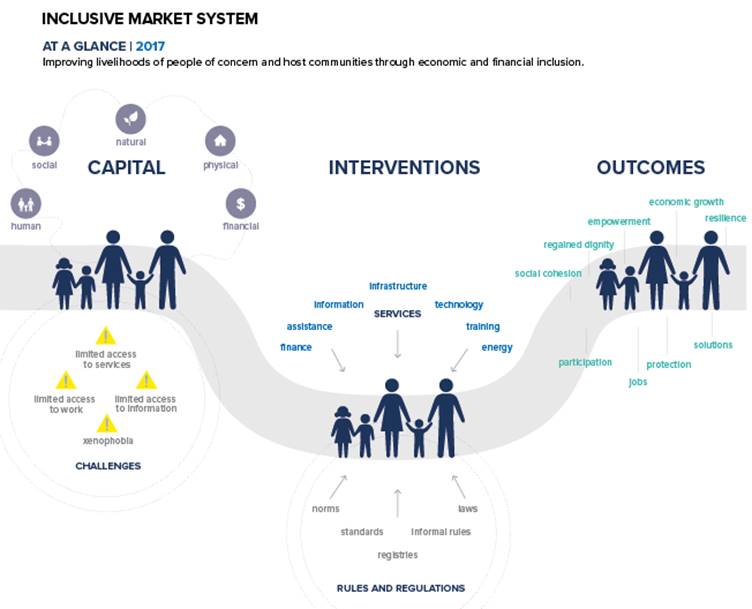

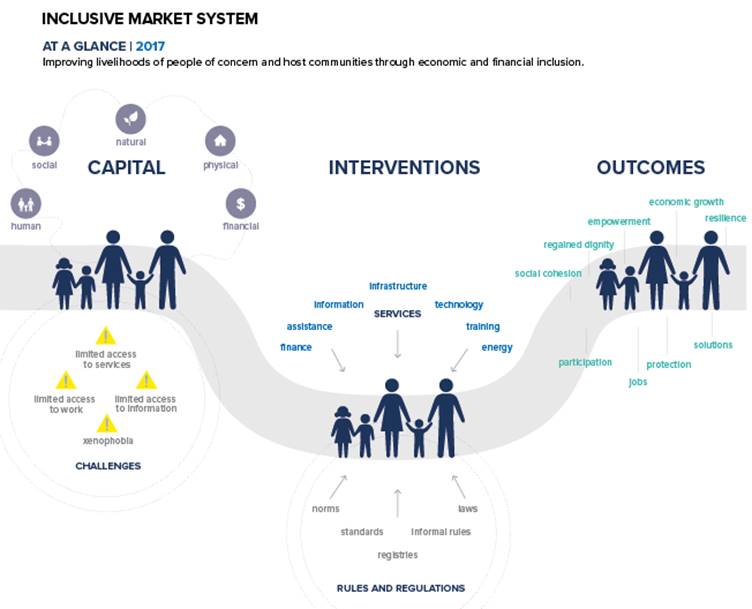

As shown in the figure below, persons of concerns‘ livelihoods outcomes and economic inclusion are supported (or restricted) by a number of factors. Inclusion into a market system depends not only on access to capital and services, but also on a conducive enabling environment shaped by rules and regulations governing rights and security. Understanding the market system and the challenges persons of concern may face is key for strategizing how to best design and engage in interventions aimed at enhancing the economic and financial inclusion of the forcibly displaced and of their host communities.

UNHCR’s priority is to play a facilitation and advocacy role, enabling and convening relevant stakeholders to include persons of concern in existing services or programmes.

In the area of financial inclusion, UNHCR engages with financial service providers (FSPs), specialized development agencies, and impact investors to facilitate the financial inclusion of refugees and other forcibly displaced. UNHCR main role entails:

- Advocacy and awareness-raising;

- Logistical support;

- Socio-economic data-sharing of the refugee population;

- Creation of linkages between development partners and FSPs;

- Financial services needs’ assessments, and

- Facilitating innovative mechanisms for market-based incentives.

In addition, UNHCR works closely with policymakers and regulators to identify barriers to refugees’ access to financial services and works to decrease these barriers. Financial regulations can hinder non-nationals or people without a passport or residence permit from opening an account; other times Central Banks allow refugees holding UNHCR registration cards to open accounts but often local banks are not aware of these policies. Hence, it is important to work with both regulators and local banks on advocacy to overcome access barriers.

UNHCR leverages the presence of its field offices, as well as the expertise of partner organizations to identify barriers to access which governments may inadvertently be applying.

In Malawi, the UNHCR Registration Card has recently been recognized as a valid document for refugees and asylum seekers to open accounts with the New Finance Bank.

In Rwanda, UNHCR has been partnering with Financial Sector Deepening Africa (FSDA), which recently released the report Refugees and their Money. The study demonstrates the business case for FSPs to profitably serving refugees in the country and encouraged a number of FSPs to pilot financial products and services for refugees in camps. The Government of Rwanda has been supporting the process by informing of the validity of refugees’ proof of registration as valid document to satisfy KYC requirements and open bank accounts.

In Zambia, UNHCR’s partner UNCDF worked with Bank of Zambia to change policy on what is an acceptable form of ID for opening a bank account, which now also includes a Refugee Certificate and Refugee ID card issued by the Government’s Office of the Commissioner for Refugees. These documents are now accepted as valid KYC documents by FSPs.

UNCDF also released on Monday a Remittance Toolkit developed in collaboration with Bankable Frontier Associates, and which was supported by UNHCR through a grant. The toolkit was created to help identify and address the unique barriers and needs of refugees in accessing affordable and regulated remittance channels. The toolkit is accompanied by a country assessment for Uganda, where the toolkit has first been implemented.

About UNHCR

UNHCR, the UN Refugee Agency, is mandated by the United Nations to lead and coordinate international action for the worldwide protection of refugees and the resolution of refugee problems. The organization delivers life-saving assistance like shelter, food and water, helps safeguard fundamental human rights and develop solutions that ensure people of concern to UNHCR have a safe place to call home where they can build a better future. It also works to ensure that stateless people are granted nationality. UNHCR works in 128 countries around the world on behalf of 71.4 million people.

About

About

Online

Online

Data

Data