By Ingrid Cyuzuzo, Subgroup Lead of AFI’s Inclusive Green Finance Working Group (IGFWG) from the National Bank of Rwanda, and AFI’s Laura Ramos, IGFWG Policy Manager

Environmental and climate change risks can have profound impacts on financial institutions and the broader economy. For instance, ecologically unfriendly or polluting businesses can contribute to climate damage which, in turn, could lead to business disruptions and increased operational costs. On the other hand, social risks can result in reputational damage and legal liabilities. Environmental and Social Risk Management (ESRM) guidelines help financial institutions identify, measure, and manage these risks, ensuring their financial sustainability and protecting both investors and customers.

ESRM guidelines encourage financial institutions to consider the potential impacts of their operations and investments on the environment and society, promoting the creation of long-term value, attracting socially responsible investors, and contributing to sustainable economic growth.

Across the AFI network, financial regulators acknowledge the need for improved environmental and social (E&S) risk management practices among lending institutions. With valuable input from its members and further observation of global trends and best practices, AFI’s Inclusive Green Finance Working Group (IGFWG) has just launched an ESRM Guideline. Intended to support credit institutions in effectively establishing ESRM within their business and operating models, the ESRM Guideline takes on a principles-based approach that considers the various structures, depths, and levels of maturity that shape the financial sectors of respective IGF working group members.¹ Below we briefly discuss the principles and implementation recommendations captured in this newly developed knowledge product.

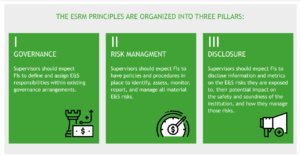

THE ESRM PRINCIPLES ARE ORGANIZED INTO 3 PILLARS:

PILLAR I: GOVERNANCE & STRATEGY

Social and environmental risks, particularly that of climate change, represent an existential threat to the financial stability of credit institutions and the systems they operate in. It is therefore essential that these risks are tackled strategically at the enterprise level. However, the principles in this section also recognize the importance of identifying the credit institution’s role in financing a sustainable transition as well as the shareholder value that rests on this opportunity. Pillar I guiding principles include:

- The foundation of effective ESRM lies in corporate governance and should be catalyzed by an understanding between the FI’s shareholders, the board of directors, and senior management

- ESRM is an issue of strategic importance and should be anchored in the FI’s strategic plan and strategic management framework

- The strategic plan should consider ESRM as a source of reward as well as risk in a similar way to other business risks such as credit, operational, and market risks

- There should be effective internal communication by senior management to FI employees regarding expected values and behaviors in relation to ESRM

- ESRM practice is an evolving discipline, but early action is essential

PILLAR II. RISK MANAGEMENT

This section follows naturally from the previous one. Building on the idea that for effective ESRM to be financially inclusive, it must include principles that relate to more than simple risk control and mitigation. Risk identification and assessment are fundamental characteristics of an effective risk management system. Effective identification of risk considers both internal factors and external factors. In general, sound risk assessment allows a FI to better understand its risk profile and allocate risk management resources and strategies effectively. ESRM, just like traditional credit risk management, must be considered a source of reward as well as risk. Therefore, taking a risk-based rather than compliance-based approach where possible is optimal. Below are Pillar II’s guiding principles:

- ESRM should form part of a holistic risk management framework

- ESRM should be embedded in the Credit Risk Management culture, and considered from the perspective of both physical and transition risk

- In addition to credit risk, ESRM is a source of operational, market, and liquidity risk and should be integrated into these functions

- Risk monitoring and reporting are key pillars of the ESRM framework

- ESRM should be covered by the internal audit and compliance functions

PILLAR III. DISCLOSURE & STAKEHOLDER MANAGEMENT

Supervisors should expect FIs to disclose information and metrics on the E&S risks they are exposed to, their potential impact on the safety and soundness of the institution, and how they manage those risks. Here’s a look at Pillar III’s guiding principles:

- Prepare for the evolving requirements of regulators in relation to E&S risks

- Follow international and local developments in corporate ESRM reporting and disclosure

- Ensure that ESRM disclosure and reporting are reflected in public relations and communications

- Successful adoption of ESRM values and behavior by staff requires internal communications, training, and skills development

- Support customers through their sustainability journeys with frank but sensitive communication on the institution’s ESRM expectations

IMPLEMENTATION RECOMMENDATIONS

Below are some initial implementation recommendations for banking supervisors as identified by AFI’s IGFWG:

- Industry Consultation: Consultation processes can elicit formal written responses from stakeholders. If followed by an industry discussion forum it may facilitate feedback and continued dialogue with regulated entities.

- Sequencing: A balance needs to be struck between improving compliance with E&S criteria without overwhelming MSME borrowers with E&S requirements since this could lead to them being excluded altogether from sustainable finance product offerings. Setting appropriate timelines for supervisory expectations in relation to implementing such reforms is difficult but critical to ensuring a balance. Upgraded risk management systems also require back-testing while data and new procedures need to be designed and trialed by management. Management and staff will need extensive training and skills development to adapt to the evolving business and operating model, and the values and behaviors expected.

- Promotion: For the successful implementation of ESRM, the exchange of knowledge between borrowers, lenders, regulators, and other stakeholders can serve as a foundation for capacity development in sustainable finance. It is important to highlight that not only do lenders need to act, but critically, borrowers will need to develop an understanding of the E&S risks they face.

- Supervisory activities following ESRM policy issuance: Following the publication of ESRM guidance, in the near term, supervisors can consider some of the activities listed below:

– Hold targeted bilateral meetings with FIs on E&S risk to promote its continued role in ongoing supervisory engagement.

– Require FIs to conduct and share results of a baseline E&S risk self-assessment, which can form a benchmark for subsequent inquiry.

– Establish a questionnaire and use it to collect information on implementation progress during on-site reviews.

– Conduct ongoing, periodic high-level dialogue with banking industry executives to discuss progress in ESRM practice.

– Encourage FIs to include ESRM compliance within their institutional audit plans

– Continue to monitor financial inclusion indicators in the context of environmental risks and opportunities as they are identified through the implementation of ESRM policy guidance.

CONCLUSION

In conclusion, ESRM has the potential to create further barriers to accessing finance, particularly for MSMEs. Failure to effectively communicate ESRM policies and principles to this under-banked cohort will only render this outcome inevitable. Credit institutions are already required to better guide customers on how to improve their financial management, business, and operating models. The additional dimension of ESRM represents an opportunity to start a potentially pivotal conversation with MSME borrowers on the institutions’ expectations of them. This may also present a chance for credit institutions to expand their offering to Enterprise Development Services for MSMEs that can potentially enhance both their sustainability and bankability simultaneously.

AFI’s Inclusive Green Finance workstream is part of the International Climate Initiative (IKI), supported by the German Federal Ministry for Economic Affairs and Climate Action (BMWK), based on a decision by the German Bundestag.

_____________________

¹ They are described as “principles” because they do not make prescriptive recommendations to banks, rather, they rely on the experience and expertise of management and staff to translate them into tangible and actionable change. In some cases the formulation principles refer to types of documentation that might typically be found in a credit institution, however, it is understood that jurisdiction and institutions will vary in the way they plan, manage, and document their business and operating models.

About

About

Online

Online

Data

Data