By CEMCWG Chairs, Wati Seeto from the Reserve Bank of Fiji, Natalia Sanchez from Superintendency of Banks of the Dominican Republic, Sevak Mikayelyan from the Central Bank of Armenia, and AFI Policy Manager, Sulita Levaux.

Trust in the financial system is based on solid consumer protection policies. Key to this are help and redress mechanisms that offer consumers access to efficient and easy-to-use complaint procedures.

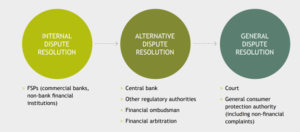

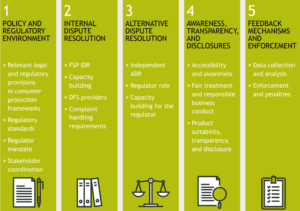

A 2021 CEMCWG survey has shown that several AFI members still face complaint procedure challenges, particularly relating to their supply- and demand-side, and their institutional frameworks.

To solve this, the Consumer Empowerment and Market Conduct Working Group (CEMCWG) recently published a Guideline Note on Policy Recommendations for Effective Redress Mechanisms in AFI Member Countries to help members improve their customer complaint protocols. Here’s an outline of their key findings.

Figure 1: Examples of AFI member challenges in help and redress mechanisms

How to achieve successful help and redress

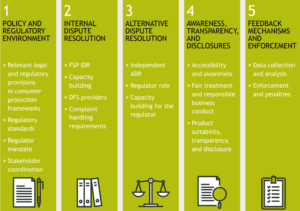

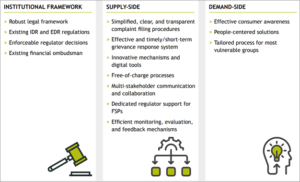

Through careful analysis of the survey and active technical subgroup discussions, working group members were able to identify five vital policies for a successful consumer complaint procedure:

- Creating a redress-friendly environment

With the right policy and regulatory environment, we can help create effective, easy-to-use complaint procedures. In the Dominican Republic, inefficient complaint handling by FSPs led the Superintendency of Banks of the Dominican Republic (SBDR) to introduce a robust institutional framework that ensures the fair, transparent and effective processing of complaints. Launched in 2006 and revised twice since, the framework first encourages consumers to access FSPs’ formal internal dispute resolution (IDR). But if the latter fails, customers are invited to direct their complaints to an alternative dispute resolution (ADR) at ProUsuario – the SBDR’s consumer protection office.

By facilitating effective help and redress mechanisms, the framework invites a healthy relationship with consumers, boosting their confidence in the system.

- Introducing IDR mechanisms for FSPs

AFI members agreed that IDR mechanisms among FSPs are critical to maintaining consumer trust and confidence.

“We’ve been focusing efforts on financial inclusion for 10 years now in Fiji, and we are still actively discussing the Reserve Bank role together with the other stakeholders involved”. Wati Seeto, CEMCWG Chair, Reserve Bank of Fiji

The Reserve Bank of Fiji (RBF) has worked closely with FSPs to strengthen their IDR processes and improve service delivery. By raising common concerns like hidden fees, incomplete disclosures, excessive waiting times, and lack of awareness, the RBF has helped FSPs improve their IDR mechanism. The number of customer complaints registered by FSPs has grown significantly since 2014 (this may be the result of increased access to financial services and customers’ awareness of redress mechanisms), while the rate of complaints that reached the RBF has dropped.

This shows how effective an IDR function can be if FSPs are equipped to resolve complaints independently.

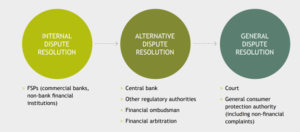

- Establishing an external appeal process

Consumers dissatisfied with IDR results should be able to appeal before an independent ADR body within a set timeframe. Besides boosting consumer confidence, independent ADRs can also incentivize FSPs to implement more effective IDR mechanisms.

To help FSPs establish adequate redress procedures, the Central Bank of Armenia (CBA) introduced a multi-tiered complaints protocol involving ADRs:

a) Consumers have the right to complain to three bodies including FSPs, the financial system mediator (Ombudsman) office, and courts;

b) If consumers are unsatisfied with FSP rulings, they can appeal through the Ombudsman office and,

c) At any point, they can direct their complaint to the courts or the CBA itself.

Figure 2: Three stages of dispute resolution

- Ensuring transparency, consumer accessibility and awareness.

Consumers should be aware of and able to navigate complaint procedures effortlessly. But the procedure should also be fair and transparent, reassuring consumers and prioritizing their protection.

The CBA does this by obliging FSPs to have an explanatory flyer on their websites and at premises to guide customers on “How to act, in case you have a complaint” (refer to flyer in Guideline Note), while Bank Negara Malaysia’s website includes a page clearly explaining the redress channels and steps to consumers.

“The certainty of receiving help and redress should things go wrong or in case of misinformation due to asymmetries or unforeseen circumstances, grants more confidence in the consumer, and boosts their ability to engage effectively with FSP and selection of financial services.” Natalia Sanchez, CEMCWG Co-Chair 1, Superintendency of Banks of the Dominican Republic

- Implementing IDR feedback and monitoring

Monitoring complaints can help track trends and identify complaint hotspots. The data can then be used to inform policies that improve the overall performance of the financial system.

In Dominican Republic, IDR supply-side data is submitted to the SBDR every quarter. It contains statistics on the types of claims handled, claim subjects, claim verdicts, the amounts involved, and consumer satisfaction levels. This data is then assessed for consumer protection supervision, policymaking, financial education purposes, and penalties for non-compliant FSPs.

Monitoring should always be supported by vigorous regulation and communication and lead to sanctioning of non-compliant FSPs.

Figure 3: CEMCWG members’ policy recommendations for help and redress mechanisms

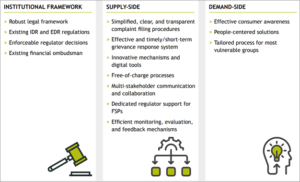

Characteristic of an effective redress mechanism

Through their discussions and survey analysis, AFI members were able to identify several policy essentials for successful redress mechanisms:

Figure 4: Characteristic of an effective redress mechanism identified by CEMCWG members

Looking ahead

To complement the Guideline Note, CEMCWG members developed a roadmap for the adoption of effective help and redress policies:

a) Develop a policy communication plan for stakeholders;

b) Take intentional action, regularly engaging with FSPs;

c) Monitor and evaluate the process with stakeholders for continued improvement.

“Effective H&R mechanisms are crucial to inspire confidence in financial services, and by extension ensuring its continued success in advancing financial inclusion. Thus, the Regulatory authorities must ensure that their frameworks and methods keep pace with market developments.” Sevak Mikayelyan, CEMCWG Co-Chair 2, Central Bank of Armenia

CEMCWG members and leaders agree that with the growing sophistication of Fintech and financial services, consumer protection is critical. The certainty provided by effective help and redress mechanisms can boost consumer confidence in the financial system and help them maximize their engagement with FSPs and the broader financial system.

_________________

AFI’s Guideline Note on Policy Recommendations for Effective Redress Mechanisms in AFI Member Countries, provides a wide range of best practices from AFI member institutions in the development, implementation, and monitoring of help and redress mechanisms. Complementary reading developed by the CEMCWG: Complaint Handling in Central Bank Toolkit (2022) and Framework (2020).

About

About

Online

Online

Data

Data